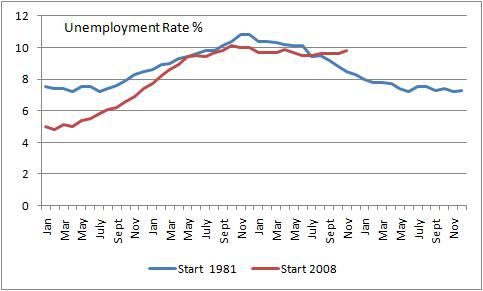

Unemployment...trends for two of our deepest recessions...similar trends...a much bigger economy now vs the 80's...will take longer to turn around...numbers should start getting better early next year...

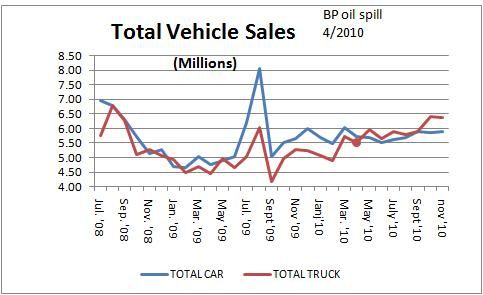

Total auto sales...all charts are SAAR data (seasonally adjusted annual rate)... slowly trending up (trucks)...the peak was Cash for Clunkers...

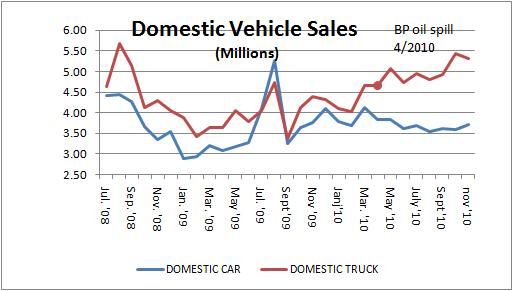

Domestic sales...trucks doing well...reasonable fuel prices helping out the trucks...rising fuel prices next year could put the kibosh on truck sales...

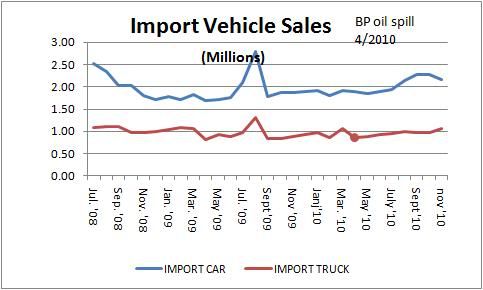

Imports sales lagging US sales..Toyota doing very poorly...Import trucks flat...steep gas prices won't hurt imports as much as the US fleet...

Overall auto sales are still at depressed levels vs historical peaks...higher quality vehicles that last far longer have caused a long term decline...

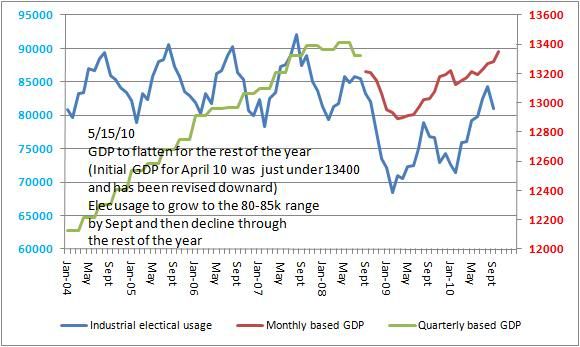

GDP...quarterly data from fed...monthly data from eforcasting...GDP not growing as fast as the historical rate...the rate of increase in the GDP (red) line is not as fast today as in the past...the reason we are not generating enough jobs to lower unemployment...total GDP output almost back to pre recession levels...

Industrial electrical usage...data from EIA...a graph you won't see anywhere else...and probably for good reason...if our factories are producing they will be using electricity...you can see the steep decline during the recession...we have climbed back about halfway to earlier levels...we are now in the winter slowdown and I expect to see usage continue to decline...hopefully no lower than the 75k level...a bottom above 75 will show the industrial base is growing...it will take 3 or 4 months to work down to the bottom...

All the above show the same thing...slow growth that is not fast enough to put laid off workers in jobs and to have enough left over for new workers...

Fuel prices are the key...will an expanding global economy put enough pressure on crude and will a declining dollar push fuel prices to the 3.50 to 4 dollar level next summer? Would the economy be able to absorb that price increase..it didn't last time...I doubt if it will this time...